670 credit rating: the basics of credit scores

Quick wisdom

- A beneficial 670 credit score is recognized as being regarding good borrowing range of the one or two main credit rating patterns.

- You happen to be able to find recognized to possess home financing otherwise car finance based on your unique finances having a great 670 credit history.

- As you could have usage of a great deal more economic ventures than just anybody which have a lower life expectancy credit rating, you will be capable discover more pros for folks who take your rating to your “excellent” diversity.

When you yourself have a beneficial 670 credit rating, you could potentially be ok with therefore it is to the large sections out of credit history selections. Although not, you’re wanting to know what so it score form and how your is also next improve they.

Insights your 670 credit rating

A great 670 credit history is in the “good” credit rating assortment, however, with the budget in the assortment, as it goes from 661-780 getting VantageScore and 670-739 having FICO ratings. You might still have the ability to be considered handmade cards, loans and you will rates having a good 670 credit rating.

To invest in property with a beneficial 670 credit rating

To acquire a property with an excellent 670 credit score is possible; but not, understand that it can be harder than simply in the event the you’d a good credit score. Certain lenders may need more substantial deposit, costs highest interest rates otherwise have more strict financing conditions.

Anything you determine, very carefully feedback and you will contrast various other lenders and you may loan choices to find your very best fit for your unique situations.

Whenever you are important, credit scores are only among products loan providers explore when granting mortgage brokers. Generally speaking, particular loan providers may require a bigger down payment, charges highest interest rates otherwise keeps more strict loan words to possess home loan applicants they might envision about “good” variety.

Delivering a car loan having good 670 credit rating

Contemplating obtaining an auto loan? To find a motor vehicle are you are able to which have a good 670 credit score, but more dealerships and loan providers are able to use additional credit reporting habits and various scales making her mortgage decisions, that could effect your loan words and acceptance chances. Even with good “good” credit score, you might be denied, susceptible to highest rates of interest or must bring a larger advance payment than if you had a higher credit score.

You could assist in improving your chances having recognition; it certainly is great for incorporate a good co-signer for the financing-in case your lender allows-to share with you financial responsibility. Every applicants is be aware one whenever you are extremely important, your credit score is just one of several factors lenders take into account when approving financing.

Bringing a credit card having a good 670 credit history

Having good 670 credit rating, you are capable of getting acknowledged to have handmade cards, like those which have travel and you will restaurants perks.

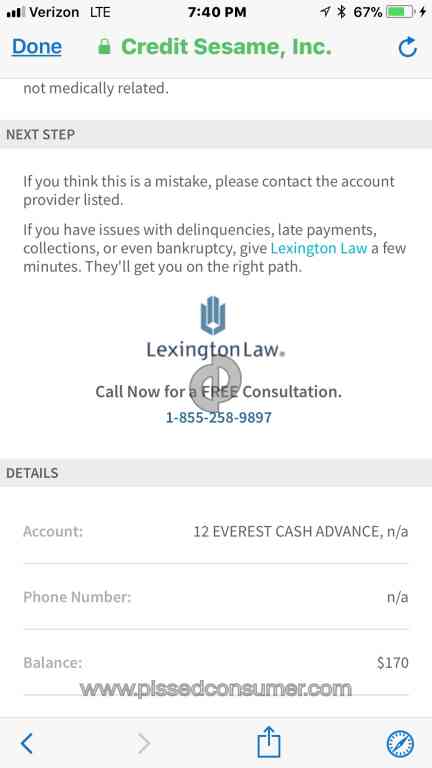

Think of, your own rating is a tool to assist loan providers dictate their creditworthiness. Nevertheless they thought other variables just like your credit report, that’ll indicate most other elements (such as, when you yourself have an excellent derogatory mark, maybe you have a more difficult go out taking recognized to possess a credit card).

Methods to help improve an effective 670 credit rating

When you are a 670 credit score is regarded as a beneficial, you’re selecting getting the get to loans in Leroy a higher height. A 750 get, such as for example, is regarded as advanced level, and having that it height you will allow you to even have way more monetary ventures.

- Actively screen your credit score and you will report. You can help yourself to do so having tools such Credit Trip where you could see your credit rating no perception and you will subscribe identity and you will borrowing from the bank monitoring alerts.

- Make your repayments promptly, since the fee background is the reason a large portion of the borrowing from the bank score.

- Cutting loans where you can. Consider using the debt avalanche strategy, snowball strategy otherwise snowflake approach to help you focus on your financial situation.

- Having fun with Credit Excursion ‘s credit rating improve element, where you can located a personalized plan available with Experian. The bundle will provide you with actions you can take to assist in improving your credit rating over time.

- Manage the lowest credit use proportion, preferably from the 30% otherwise smaller.

Key takeaways

Having an effective 670 credit rating usually means that you’re on best tune. You will be developing healthy activities, but you may feel restricted to a number of debt solutions. Whether you are trying improve your score to truly get your need credit card and other loan, you can need hands-on procedures into the increasing your credit rating over time. Over the years and you can structure, you will be in a position to size your get from advisable that you expert.