Qualifying to have a home loan: the 5 C’s

- Upsizing empty-nester fantasizing away from miles to help you roam

- Downsizing zoom towner happy to traveling

- Multi-generational mastermind that have renovation ideas galore

Whenever you are an initial-go out homebuyer, initiate here. If it is been a little while because you wandered our home-to acquire procedure, relax knowing. This guide talks about owning a home fashion, simple tips to right dimensions, and various mortgage designs. Addititionally there is a good refresher towards stages in the brand new homebuying techniques.

Rightsizing to have life’s milestones

Lives milestones results in big changes. ily, modifying operate, retiring. Men and women occurrences are a good time for you wonder: Really does my latest home nonetheless see the boxes I wanted they to help you? When it will not, it can be for you personally to rightsize.

- Exactly how many rooms – bed rooms, practices, common components, restrooms – do you really need?

- Might you save money time outside the household compared to they?

- Does your house carry positive or bad memories?

- Is someone happy and able to carry out repair toward lawn, pool, or shop?

- Do multi-accounts help your loved ones dynamic, or will they be a threat?

Continue you to definitely most useful 2nd household in mind because you start to policy for ideas on how to achieve they – including providing home financing.

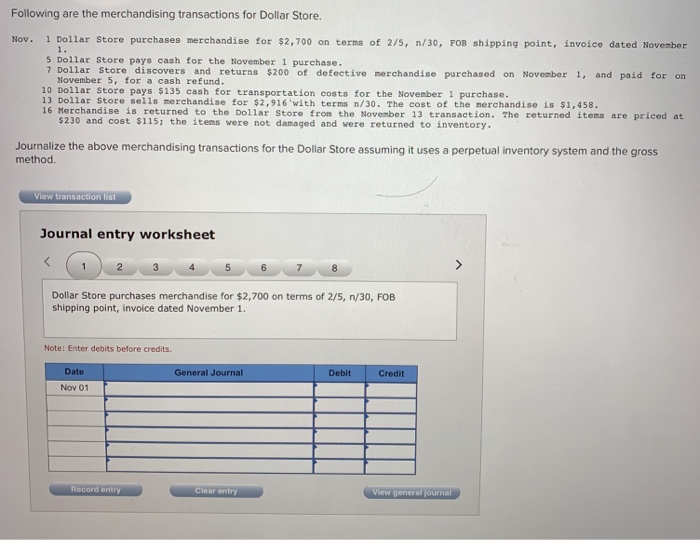

Hardly any lenders allow residents to transfer an existing financial to help you an alternative household. That implies you will have to go through the home loan process again. People bank – Numerica provided – would like to be sure to have the ability to accept financial debt. During the Numerica, we mate to you because of the evaluating every home loan programs with the 5 C’s:

- Character: Your credit report, employment background, long-name economic requirements, as well as your total connection with Numerica

Numerica caters to people – not merely individuals with prime credit scores. We work with expertise you and the way you control your currency. I and make financing choices in your community and on just one foundation.

Know mortgage options

There are a lot loan possibilities, it does feel like a lot. Check out of one’s distinctive attributes of the house finance offered at Numerica.

Numerica’s Home loan Class consists of gurus towards the of them alternatives. Get in touch with them to discuss your aims additionally the best mortgage for your state.

Refresher direction: 5-step homebuying process

Willing to diving to the homebuying techniques while making the next home possible? From inside the positive information, they most likely hasn’t altered much since you bought very first domestic. You need to ensure you get your money managed, find out what you can afford, make an application for that loan, look for a home, to make the render.

Be honest on what you may be comfy shelling out for the next household. Commonly anybody else advice about the mortgage into a multiple-generational house? Have you got more funds at hand now that the fresh students have remaining? As well as reason behind additional expenditures that include the domestic pick. Closing costs can vary from three to six % of your brand new residence’s full purchase price. These include mortgage origination fees, home all about home inspections, and much more.

Professional suggestion dos: Many loan providers make it out-of 4-6 mortgage co-people. If you’re supposed new multiple-generational household station, this might let. A co-applicant’s income ount. But most of the co-candidates are responsible for loan repayment if the primary applicant non-payments.

Expert suggestion 3: Don’t want to located prescreened also offers out of borrowing or insurance rates? You could register during the optoutprescreen so you can opt away out of has the benefit of one weren’t specifically expected by you.

Seeking the next home is just as enjoyable as hunting to suit your very first household. Request family-search websites. Focus on an agent to incorporate postings that suit your needs. Real estate agents will often have early accessibility the latest postings and certainly will pull comparable land in your neighborhood.

Pro idea: Some Realtors can offer a lower life expectancy percentage if you use all of them on the household pick and you may family purchases. That https://paydayloansconnecticut.com/naugatuck/ it features extra money on the pocket.

The offer phase moves punctual. An agent helps you navigate deals, prevent even offers, and you may deals. For individuals who very own a preexisting home, you will need to ple, you age to sell the home you’re residing before you can disperse.

Numerica: lenders per stage out of existence

This article is delivered to instructional purposes just that is not meant to alter the recommendations off a monetary advisor, loan representative, otherwise similar top-notch. The newest advice considering when you look at the article was particularly just and you can may not affect your situation. Due to the fact all of the disease differs, we advice talking with an expert you faith regarding the specific requires.